When a note's maker pays according to the terms specified on the note, the note is said to be honored. The total interest on a six‐month, 10%, $2,500 note is $125, so if D. Brown honors her note, the entry includes a $2,625 debit to cash, a $2,500 credit to notes receivable, and a $125 credit to interest revenue. To illustrate notes receivable scenarios, let’s return to Billie’s Watercraft Warehouse (BWW) as the example. BWW has a customer, Waterways Corporation, that tends to have larger purchases that require an extended payment period. On January 1, 2018, Waterways purchased merchandise in the amount of $250,000.

LM Funding America, Inc. Achieves Over 1,260% Year-Over-Year ... - InvestorsObserver

LM Funding America, Inc. Achieves Over 1,260% Year-Over-Year ....

Posted: Mon, 14 Aug 2023 12:30:00 GMT [source]

The difference between notes receivable and traditional loans is that banks do not make these loans directly to borrowers. Instead, they sell them to investors and institutions who purchase them as investments. Notes receivable are often used as collateral for loans and other forms of financing.

Examples of Notes Receivable

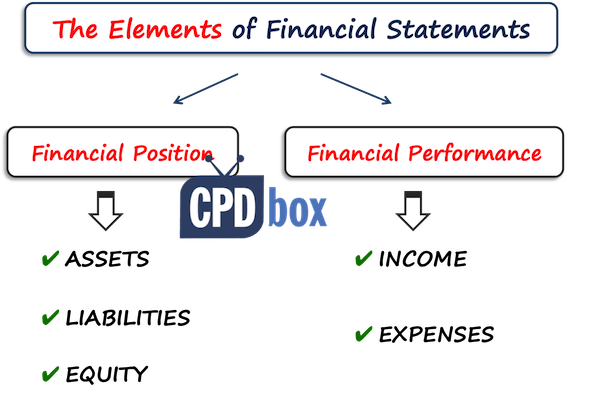

Notes receivable are usually recorded on the balance sheet as assets and are marked down to their present value. Notes receivable are a balance sheet item that records the value of promissory notes that a business is owed and should receive payment for. A written promissory note gives the holder, or bearer, the right to receive the amount outlined in the legal agreement. Promissory notes are a written promise to pay cash to another party on or before a specified future date.

Amortization of discount or premium shall be reported as interest expense in the case of liabilities or as interest income in the case of assets. Amortization of debt issuance costs also shall be reported as interest expense. Tim’s Tool Co. wants to expand into new territory, but it doesn’t have the capital to do it. Tim decides to get a bank note for $100,000 from First Bank to purchase the new equipment he needs. Tim signs the note as the maker and agrees to pay the bank back with monthly payments of $2,000 including $500 of monthly interest until the note is paid off. Many businesses use accounts receivable aging schedules to keep tabs on the status and well-being of AR.

The Difference Between Accounts Payable and Notes Payable

Overdue accounts receivable are sometimes converted into notes receivable, thereby giving the debtor more time to pay, while also sometimes including a personal guarantee by the owner of the debtor. Notes receivable have a higher probability of payment than purchases made on simple credit, which are known as open trade receivables. That’s because of the signed promissory note, which can be presented as evidence in a legal proceeding. In addition, notes receivable can potentially be sold to third parties.

As at 31 December, the note receivable from ABC is classified as a non-current asset because it is due after 12 months from 31 December. Interest receivable on the note as a 31 December is reported as current asset because it is to be received What are notes receivable at the end of April 20X5. We hope this brief guide has given you some insight into what notes receivable is, how it works, the difference between notes receivable vs accounts receivable and how to handle notes receivable on your balance sheet.

- A note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates.

- When a business issues a note receivable to its customer, it creates an asset on its balance sheet that represents future cash inflows.

- Both the items of Notes Payable and Notes Receivable can be found on the Balance Sheet of a business.

- Notes receivable can convert to accounts receivable, as illustrated, but accounts receivable can also convert to notes receivable.

BWW agreed to lend the $250,000 purchase cost (sales price) to Waterways under the following conditions. The conditions of the note are that the principal amount is $250,000, the maturity date on the note is 24 months, and the annual interest rate is 12%. A written promise from a client or customer to pay a definite amount of money on a specific future date is called a note receivable.

Key Components of Notes Receivable

When a note's due date is expressed in days, the specified number of days is divided by 360 or 365 in the interest calculation. You may see either of these figures because accountants used a 360‐day year to simplify their calculations before computers and calculators became widely available, and many textbooks still follow this convention. In current practice, however, financial institutions and other companies generally use a 365‐day year to calculate interest.

Notes receivable are short-term, unsecured promissory notes that can be issued by a company to raise funds. Notes receivable are used as a financing source for the company and are typically issued to investors who are willing to accept a lower interest rate than they would receive from a bank or other lending institution. Notes receivable are financial instruments that represent the debt owed by a debtor to the lender.

Accounts Receivable vs. Accounts Payable

These are written agreements in which the borrower obtains a specific amount of money from the lender and promises to pay back the amount owed, with interest, over or within a specified time period. It is a formal and written agreement, typically bears interest, and can be a short-term or long-term liability, depending on the note’s maturity time frame. When it becomes clear that an account receivable won’t get paid by a customer, it has to be written off as a bad debt expense or one-time charge. Companies might also sell this outstanding debt to a third party—known as accounts receivable discounted or as AR factoring.

More sophisticated terms and real-world circumstances can quickly complicate the straightforward example above and cause Sparky exponential accounting work. If Sparky’s fiscal year ends during the note receivable term, additional journal entries are required for interest accruals. And if Joe fails to pay any part of the note, Sparky would need journal entries to record write-offs. While using notes receivable benefitted Sparky’s cash flow and collection effort, it’s easy to see how labor-intensive and potentially error-prone manual bookkeeping can become from just a single transaction. Notes receivable have several defining characteristics that include principal, length of contract terms, and interest. The principal of a note is the initial loan amount, not including interest, requested by the customer.

Or, we can combine this entry with the journal entry for the repayment of the note. Rather than using Interest Receivable for the one day of interest in April, we record it as part of the cash payment, skipping the step of first entering it in the receivable. This adjusting journal entry is needed to conform to GAAP, recording revenue in the month it is earned.

- Notes receivable have several defining characteristics that include principal, length of contract terms, and interest.

- A written promise from a client or customer to pay a definite amount of money on a specific future date is called a note receivable.

- The adjusting entry debits interest receivable and credits interest revenue.

- This can make bookkeeping cumbersome, especially for companies that hold multiple notes receivable.

There is also generally an interest requirement because the financial loan amount may be larger than accounts receivable, and the length of contract is possibly longer. A note can be requested or extended in exchange for products and services or in exchange for cash (usually in the case of a financial lender). Several characteristics of notes receivable further define the contract elements and scope of use. Notes receivable, also known as promissory notes or IOUs, are a type of financial instrument that represents a written agreement between the borrower and lender. Unlike accounts receivable which involves transactions on credit sales, notes receivable arise from loans made by businesses to their customers.

For example, an individual or company may use their notes receivable as collateral for a mortgage loan to purchase a home or other real estate property. The note has now been completely paid off, and ABC has recorded a total of $246 in interest income over a three-month period. The payee is the party who receives payment under the terms of the note, and the maker is the party obligated to send funds to the payee.

A note will often be for less than a year, but some can be well in excess of this time frame. Recognize notes receivable income as interest income on the income statement. Thus, when payment is made the amounts effect the balance sheet as well as the income statement.

TreeHouse Foods, Inc. Reports Second Quarter 2023 Results - PR Newswire

TreeHouse Foods, Inc. Reports Second Quarter 2023 Results.

Posted: Mon, 07 Aug 2023 07:00:00 GMT [source]

This examines a note from the lender’s perspective; see Current Liabilities for an in-depth discussion on the customer’s liability with a note (payable). On March 31 a similar entry will be made to record the interest revenue earned in March. On February 28 a similar entry will be made to record the interest revenue earned in February. Interest Receivable is an Asset account so it has a normal debit balance. Interest Receivable is increased on the debit (left) side of the account and decreased on the credit (right) side of the account. Notes Receivable is an Asset account so it has a normal debit balance.